The Rising but Invisible Tide

In payments, invisible is beautiful.

Exchanging, routing, and transferring money among transacting parties are among the oldest, critical — and often most complicated — functions performed in financial services. Today, many of the most visible examples of successful startups such as Stripe and Plaid are performing some of the most invisible functions and gaining fame while doing so. Against this backdrop, we ask: how are forces stemming from the COVID-19 pandemic reshaping this increasingly high-profile ecosystem?

This foundational FinTech subcategory runs across many sub-sectors within financial services from lending and wealth management to investment and capital markets. In this way, payments is both a horizontally — and vertically — oriented category.

The impact of the COVID-19 pandemic on payments mirrors the breadth and depth of the category itself: individuals, communities, companies, governments, and economies across a multiplicity of payment methods and formats: cash, credit/debit cards, ACH, mobile wallets, and cryptocurrencies.

Any of the following players experience payment technology differently than the next and are each experiencing the impact of COVID-19 asymmetrically:

- Cash Enablers such as printing companies like G+D; ATM manufacturers like Diebold Nixdorf and NCR; and cash handling players like Brinks and Loomis.

- Payment Networks and Credit Card Schemes such as Visa & Mastercard that help banks and card issuers move money among a growing network of cardholders, merchants, and other transaction endpoints.

- Brick & Mortar Merchant Acquirers and Card Processors like First Data and TSYS who are working with point-of-sale (PoS) hardware providers such as Ingenico or Verifone, as well as newer players like Square, SumUp, and Loqal “democratizing” acceptance for smaller shops.

- Online/ E-Commerce Payment Processors like PayPal and payment infrastructure enablers Adyen.

- Remittance and Forex players like Western Union, MoneyGram and CurrencyDirect, as well as newer players like TransferWise and Remitly.

- Payment Enablers and Subcategories across payment specialists aimed at security, fraud prevention, loyalty programs, wearables, analytics etc.

These players can be grouped or segmented in different ways, but we highlight the above to demonstrate both the scope of the parties embraced and the variance of their present experience in the payment ecosystem.

By examining each against the five force factors we see manifesting as a result of the COVID-19 pandemic, we can distill a number of plot lines, make some educated guesses about their direction, and ultimately influence our decisions as an investment team.

The impact of COVID-19 on payments has been far from uniform. As payment flows are a basic economic enabler, movement of money at a certain level remain in place because they are so deeply rooted and so necessary for the everyday lives of individuals and companies. As a result, bill payments, grocery purchases, corporate treasury functions, and securities transactions may have certainly experienced disruption or irregularity of flow but, nevertheless, tend to remain in place. However, as for the form factor(s) involved, this is an exciting area to keep an eye on from our perch.

Banks, governments, and regulators in countries or regions that are impacted acutely will do whatever it takes to move money fast.

The fact that digital payments have been within reach for stimulus initiatives rolled out by many countries worldwide underscores the attractiveness of the digital format.

The imperative for speed of transmission emphasizes the advantages afforded by payments of digital means and elevates their adoption as fit not only at the individual or the company level but at the level of state economies.

The way in which the five forces we have identified tend to intercept the functions of the ecosystem players outlined earlier reveals the character of pulse of the impact of COVID-19 on the payments sector at present.

Dispersal: Immediate Exposure & Vulnerability of those parties that are not (yet) Digitally-Enabled

The travel, tourism and hospitality sector has taken a big hit from economic fallout resultant from the pandemic. Brick & mortar payments players have suffered as well, while online/e-commerce-focused players are meanwhile seeing an uptick in revenues and volumes ranging from 25% to 200%[1]. Smaller card issuers with thinner cushions are also likely to be hit as loss rates shoot up due to displacements in employment. The pressure to go digital is greater than ever. Providers that help eliminate physical processes or paper documents across the value chain will be in demand.

Inertia: Fraud Risk and Overcoming Paralysis for Change

As governments move to cushion the impact of the crisis on small businesses, freelancers and the unemployed, they are also seeing a surge in associated fraud. These players are rightfully cognizant of the associated risks and vulnerabilities that a sudden digitization of their businesses could bring about. However, if these risks bring about too great of a pause, then the unintended consequence of a long and drawn-out survey of providers in the space could result in a great deal of inertia for change required on an accelerated timeline.

Yet another factor compounds this risk for indecision on making the right next move: corporates moving money to and from their customers, suppliers and employees will need to find new workarounds, especially if these forms previously relied on checks. Those that cannot quickly mobilize these resources for change could find themselves without the means to contribute to a turnaround. For example, the local government of Qingdao in China distributed vouchers through Tencent’s WeChat Pay infrastructure in the midst of the pandemic to encourage immediate spending.

Financial services incumbents and payments startups have the opportunity to collaborate at this juncture.

Payment providers — established and emerging, alike — that can help ensure that money is going to the right companies and individuals for the right purposes at the right time and execute on it securely will become increasingly relevant in overcoming the challenges of the day, including those posed by analysis paralysis.

Digital Volume: Blurred Lines at Home & Work Compound Payment Data Opportunities and Security Challenges

With lockdowns and social distancing measures in place, consumers, employees, and businesses are already one year into their experiments of moving functions online at a rate never before seen.

Activities on the part of individuals in their capacity as employees and as customers are increasingly blended as their computers at home become their portals to the rest of the world. Although the data throughput here is greater in volume and thus presenting a greater opportunity to parse the data thus amassed, there are also clear risks.

The flow of payments amid increasingly vague demarcations between home and work result in co-mingled flows, as well. Employees’ actions take place under one roof, and increasingly so do their transactions.

Employees consume online shopping, food delivery and home entertainment all while working from home via online meetings, file sharing tools, etc; payments, subscriptions and personal/work accounts underpin all of this. While this pushes up the volume of digital payments, it also escalates risks related to online fraud, account hacking, and phishing attacks that thrust the payments space into one immediate battleground for cybersecurity.

Segmentation: Emergence of Niche Needs Multiplies the Proliferation of Niche Players

A post-COVID-19 climate, even in a recovery scenario, is likely to drive a segmentation of transferable, stored value assets and their supporting infrastructure. For example, a Mastercard survey of 17,000 card users across 19 countries in April 2020 indicated that over 80% of respondents see contactless payments as a cleaner way to pay.[2] If this sentiment around cleanliness persists, this could drive further adoption in relatively under-penetrated markets, such as the US, thus creating an attractive opportunity for issuers as well as PoS providers.

If the backdrop of the pandemic is serving as an accelerant to a change in enterprise behavior, is it also the greatest opportunity to shift consumer payment habits since the advent of the credit card?

Contactless payments are an example of the emergence of a niche feature (or even a niche subcategory) that now sees significant demand. Another emergent niche sub-category is transaction security providers expert in anonymizing and tokenizing identities to mask personal identifiable information (PII).

The payments stack could increasingly see niche players filling these specific needs and occupying specific and critical roles in an increasingly segmented stack. If this is the case, can we also see greater prowess among aggregators and aggregators-of-aggregators?

Large payment infrastructure players that encompass a broad set of payments features will need to think through how (or whether) they wish to accommodate, partner with, or acquire these smaller players.

Survival: Payments Players can Hew Closely to Current Market Trends or Choose to Define New Ones

For startups and incumbent players in the payments space, improving their chances of survival will mean staying close to, planning for, and adapting to market shifts lest they be outpaced by those that are truly pushing the envelope of market paradigms.

For example, cash withdrawals saw a surge at the beginning of the pandemic in multiple regions, followed by moves toward contactless/card-based payments at stores offering essential services. This forced pharmacies, bakeries, kiosks, and grocery stores to ensure card acceptance and occasioned an increase in online delivery services for the associated goods.

As lockdowns ease, one can expect further shifts in the types of services offered by businesses, and the payment companies that enable their commerce. In the case of cashless payments, this creates new angles for players to align with macro payment trends and such startups have the opportunity to enable these modalities. In the case of high-touch, cash-based payment methods, these innovations pose threats to the status quo.

Further still, that status quo consists not only of the cash-based transaction world but also those business model innovation plays that are not paired with meaningful infrastructural enhancements.

Infrastructure plays must be coupled with payment workflows that are fit-for-purpose and, likewise, so-called digital first plays must also unlock features beyond the online analog of an offline workflow.

Institutions and startups can both go further by steering the direction of the new norms being established right now.

Observations in Emergent Subcategories:

The restrictions on in-person purchases — and the associated payments and/or financing — are not going away any time soon. Amid this backdrop, a quick run through of companies we are in close contact with (including those we have already made an investment in and those we are yet to) reveals a mix of risks and rewards, for example:

- Payment Orchestrators While there is no dearth of payment methods, solutions that can handle bidirectional payments via multiple methods across geographies can give enterprises a strong advantage, e.g., insurers looking to accept premium payments and pay out claims digitally. We see solutions such as these emerge stronger from the crisis.

- Payment Consolidators The last 5–7 years has seen a plethora of FinTech solutions rushing to supply digital/e-commerce SMEs with solutions to support their banking and payments needs. However, customers now have to use and pay for 4–6 providers to manage their financial value chains (payment service providers, bank accounts, FX intermediaries, Crypto service providers, card issuers, etc). We are seeing the rise of consolidators possessing superior re-bundled offerings.

- Virtual ATMs The expected decrease in demand for virtual ATMs was offset. The startups that enable retail outlets to become cash points via an app were in fact boosted because their typical partners: pharmacies, groceries, bakeries etc. were among the only outlets allowed to do business during the crisis. We expect that the cost pressures on banks resulting from the crisis will force them to reduce ATMs and branches further, with further upside for virtual ATMs.

- Payment Risk Management As significant chunks of payment flows shift online and away from cash, cheque, etc. there are immediate opportunities for solutions that address fraud, manage risk and support compliance among both consumer and B2B flows. Government aid programs have launched, employees have been laid off, and entirely new online customer segments such as those of an advanced age have adopted online mobile payments for the first time. Each use case brings along with it risks that need to be solved for.

- Wearables & Contactless Payments Startups that enable contactless payments for wearables already face positive prospects in the medium and long-term. At present, they are well positioned to take their offering to banks who want to offer a “cleaner” way to pay. The Mastercard survey quoted earlier also indicated that 75% of respondents intend to continue using contactless payments well after the crisis.

- Customer Onboarding & Credit Checking Startups enabling online customer onboarding and credit decisioning see short-to-medium-term opportunities around enabling income verification where physical statements are either unavailable or impractical. As the crisis draws on, this could reshape the retail banks’ credit decisioning and front-office teams forever, as digitalization will drive automation. We expect customer onboarding and credit decisioning at PoS (whether offline or online) to take off, offering a significant opportunity for payments players.

- Treasury Services & Cash Management As corporates and treasury teams navigate shifts in their cashflows, they seek better visibility into liquidity, working capital, and cash flow forecasts. We expect FinTechs addressing this space to see increased demand.

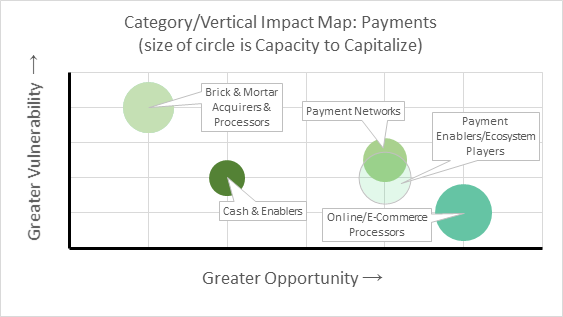

The graph below compares, at a high level, how we observe a selection of payments sub-categories experiencing both opportunity (x-axis) and as well as vulnerability (y-axis) amid the COVID-19 pandemic. The size of each sub-category’s circle indicates the greater (or lesser) potential capacity that players in this space — including startups — possess in capitalizing on the opportunities presented. In short: which sub-categories could be primed for big shifts?

Conclusions: Initial Payment Shakeups Continue to Reverberate through Markets

Tracing the impact of COVID-19 along the fragmented and often complex chain of payments players runs across many vectors: transaction volumes, payments revenue, merchant service shifts, and others. Overall, expect revenue growth in global payments to turn negative, instead of growing by 6%, as projected previously in McKinsey’s 2019 global payments report. Activity could drop by as much as 8% to 10% of total revenues, or a reduction of $165bn to $210bn.[3]

Retail payments and merchant services businesses are expected to take the biggest hit, while remittances, the sharing economy and FinTech startups that support it will suffer as well.

On the other hand, the rise of payment orchestrators and consolidators could force large sectors with ancient payments infrastructure (e.g., insurance) to offer and accept digital payments, and push SMEs towards one-stop-shop solutions that span payments, acceptance, remittances, and many of the niche products & services mentioned earlier.

Cash and cash enablers saw an upsurge at the start of the crisis in most regions, as citizens began to hoard money. Despite the move to “cleaner” payment methods like contactless cards, cash is not going away and the associated players from ATM providers to note-printers are expected to remain relatively unaffected in the medium term.

Despite this persistence of cash, online payments have seen a step change. After the first days of the crisis resulting from the pandemic, most regions saw a surge in e-commerce and associated online payments. Over this past year we have, indeed, seen this trend persist. These players acquired new customers who had never before ordered online.

How will the flows of these newly digitally-activated customers behave? More importantly, what new characteristics in the payment value chain will manifest as a result of the increased digital payment volumes, overall?

As per Bain & Company’s analysis of a PYMNTS consumer survey, this could result in up to a 65% drop in credit card payment volumes, a 50% drop in (incumbent institution and startup) revenues from cross-border payments, and nearly 30% loss in market capitalization of large payment companies. [4] The increase in digital volume may be a windfall for some but it begs the question — how distributed will the strains and opportunities sit, and who will capture them?

The sectors hit hardest by the crisis — travel, transport, tourism, restaurants, and retail account for nearly two-thirds of payment volumes worldwide. The drop in travel and tourism and the associated spend is estimated to hit the United States particularly hard, as tourist spend accounts for nearly $210bn annually.[5]

As players impacted by these trends begin to cross their fingers for a resurgence in travel, what might the impacts on payment flows look like? We are fascinated to follow how incumbent organizations and new entrants, alike, choose to play this.

Other articles in this series:

Series Header: Impact of COVID-19 on the Areas in which we Invest

[1] https://www.capco.com/Intelligence/Capco-Intelligence/Covid-19-And-E-Commerce-Will-The-Rise-In-Digital-Payments-Continue

[2] https://www.prnewswire.com/news-releases/mastercard-study-shows-consumers-in-lac-make-the-move-to-contactless-payments-850309353.html

[3] https://www.fintechmagazine.com/fintech/mckinsey-how-coronavirus-changing-payments

[4] https://www.bain.com/insights/behind-the-scenes-of-commerce-covid-19-hits-the-payments-sector-hard-snap-chart/

[5] https://www.paymentssource.com/list/how-coronavirus-could-change-the-payments-industry

Photo by Michael Dziedzic on Unsplash